A Familiar Challenge: Delivering Durable Income in a Shifting Landscape

Income generation remains a central and increasingly complex challenge for advisors today. Traditional fixed income vehicles, once relied upon for stability and yield, have faced structural pressures from prolonged interest rate volatility, inflationary erosion, and inconsistent total returns. Meanwhile, risk-adjusted opportunities across public and private markets have become more difficult to source without accepting additional complexity, liquidity constraints, or heightened downside exposure.

Advisors are tasked with navigating these conditions on behalf of income-oriented clients, particularly retirees or those approaching retirement who require predictability over speculative growth. In this environment, many professionals are revisiting overlooked corners of the income landscape, including asset classes that may have been misunderstood or mischaracterized in the past.

Residential credit is emerging as one such area. While often underappreciated, its structural fundamentals position it as a potential solution for those seeking income strategies that combine yield with transparency, asset backing, and resilience.

Revisiting Residential Credit in a Modern Context

Residential credit refers to investment strategies revolving around exposure to non-government guaranteed U.S. mortgages, either in securitized or loan form. Although the asset class has been part of institutional portfolios for decades, its current form bears little resemblance to the structures that contributed to the 2008 financial crisis.

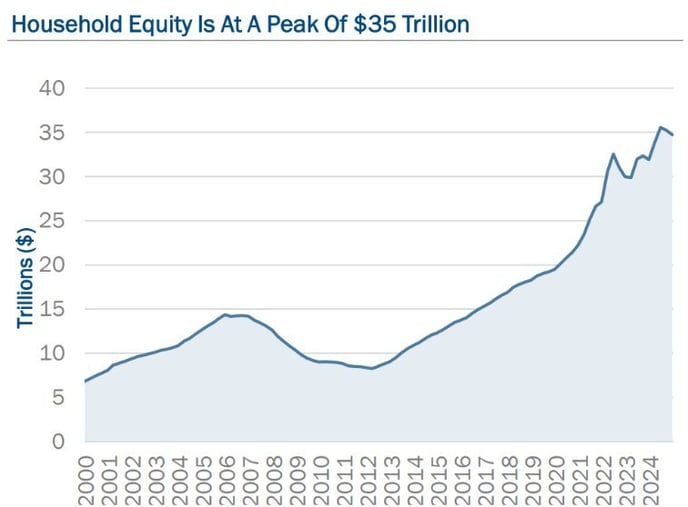

Today’s residential credit landscape is shaped by multiple structural improvements. U.S. homeowners currently hold more than $35 trillion in home equity, a level of embedded collateral that serves as a significant buffer against default risk.

Source: Federal Reserve Bank of St. Louis, J.P. Morgan, Bloomberg, Mortgage Bankers Association

Additionally, credit quality among borrowers remains high: Experian data reports that as of Q2 2024, the average credit score for mortgage borrowers stood at 758, well above the national average of 715.

These conditions reflect the results of post-crisis regulatory reforms and a more conservative mortgage underwriting environment. Loan-to-value (LTV) ratios are generally lower, documentation requirements are more stringent, and borrower profiles are stronger. In aggregate, these trends support a more stable and risk-aware investment environment for residential credit securities.

Key Structural Strengths Supporting the Asset Class

Several structural factors distinguish residential credit from other forms of fixed income or structured credit. Among them:

- High levels of homeowner equity: Elevated property values and conservative LTVs contribute to meaningful collateral support in the event of borrower distress.

- Tightened lending standards: Higher average credit scores and reduced speculative lending mean that recent-vintage mortgage pools tend to reflect more creditworthy borrowers.

- Persistent housing supply constraints: Many U.S. markets continue to experience structural housing shortages, a condition that helps support home price stability over time.

- Lock-in effect: Homeowners with low-rate legacy mortgages have limited financial incentive to refinance or sell. This creates a further housing shortage, which helps bolster prices. It also drives homeowners to look at non-traditional mortgage products, such as second lien loans, to extract equity value from their home.

- Elevated income potential: Depending on market conditions, structure and sector, certain residential credit instruments have recently offered yields in the 6–10% range. Some securities also feature floating-rate mechanisms, which may offer protection in rising-rate environments.

Together, these characteristics may provide a profile that can blend durable income generation potential with real asset exposure, traits that are increasingly valuable in portfolio construction today.

A Fit for Today’s Income-Focused Portfolios

While residential credit should not be viewed as a one-size-fits-all solution, its modern form aligns with many of the objectives advisors are seeking to achieve: yield, risk mitigation, collateral transparency, and liquidity.

When incorporated thoughtfully, it may serve as a core or complementary allocation alongside traditional fixed income, private credit, or real assets. Advisors evaluating these instruments will need to assess structure-specific elements, such as credit tier, duration, and liquidity, but the broader asset class presents a meaningful opportunity for differentiated, income-oriented exposure.

For clients seeking income with clearer visibility into underlying risks, and for advisors looking to balance yield with defensibility, residential credit warrants a fresh look.

To learn more about residential credit and its role in modern portfolio design, Ellington’s New Income Equation eBook offers deeper insights. Request a copy or follow this series to stay informed as the landscape continues to evolve.